Introduction: You know, I’ve been thinking a lot about how we can make our homes more energy-efficient, especially with so many options to save some serious cash. It turns out the federal government has a bunch of programs just for folks like us looking to upgrade. They offer things like tax credits and rebates aimed at making our homes greener, especially if you’re looking into stuff like insulation or heat pumps.

Energy Efficient Home Improvement Tax Credit

Let me break down a couple of big ones: First, there’s the Energy Efficient Home Improvement Tax Credit, where you can actually get back up to 30% of what you spend on insulation. That could be a decent chunk of change—up to $1,200 a year, though if you’re going all out with some major upgrades, it could even be $3,200. The catch? It’s got to be for your main home and specific materials like fiberglass or mineral wool.

High-Efficiency Electric Home Rebate Act

Then there’s the High-Efficiency Electric Home Rebate Act—fancy name, I know—but it’s pretty straightforward. It’s tailored for low- to moderate-income families, offering rebates covering up to 100% of insulation costs or $1,600, whichever is a better deal for you.

Local Utility Rebates

Don’t just stop at the federal level, though! Your local utility companies often have additional rebates, and when you start stacking these savings together, it really adds up. Imagine not only cutting down your utility bills but also making your home cozier and more sustainable. Plus, it’s a good feeling knowing that you’re doing your part to cut down on energy use and emissions.

Take Action

So, what’s stopping you from diving into these savings? It’s like a win-win for your wallet and the planet.

Discover Savings Through Federal Tax Credits for Insulation and Energy Efficiency

Did you know there’s a way to save some serious cash while making your home more energy-efficient? That’s right—the Energy Efficient Home Improvement Tax Credit (officially known as the 25C) is designed just for folks ready to make their homes cozier and more eco-friendly. Here’s the scoop: homeowners can get back a chunk of their insulation costs—up to 30%, with a cap of $1,200 every year. Now, if you’re ambitious and diving into a full-scale energy upgrade, that cap bumps up to $3,200. Here’s how it breaks down: $1,200 is earmarked for things like insulation and similar home envelope improvements, and another $2,000 can go toward nifty upgrades like heat pumps or biomass systems.

But here’s the catch… This tax credit only applies to your main residence—not any new builds or rental properties. And there’s a timeline to stick to—make sure you buy and install your insulation between January 1, 2023, and December 31, 2032. Come tax season, you’ll need IRS Form 5695 to cash in on these savings.

How to Stay on Top of Tax Credit Deadlines

Figuring this all out means getting your ducks in a row (sooner rather than later). Start by hunting down the insulation materials you need and plan out the installation. Filing the correct form, IRS Form 5695, with precise records of your expenses is crucial. Miss out on those details, and you might face a hiccup in getting those credits.

Which Homes and Products Qualify for Insulation Tax Benefits?

Homes in the running for these benefits are pretty varied—think single-family homes, mobile homes, manufactured homes, houseboats, condos, and co-op apartments. However, those vacation getaways and rental properties can’t participate. It’s all about your primary place of residence.

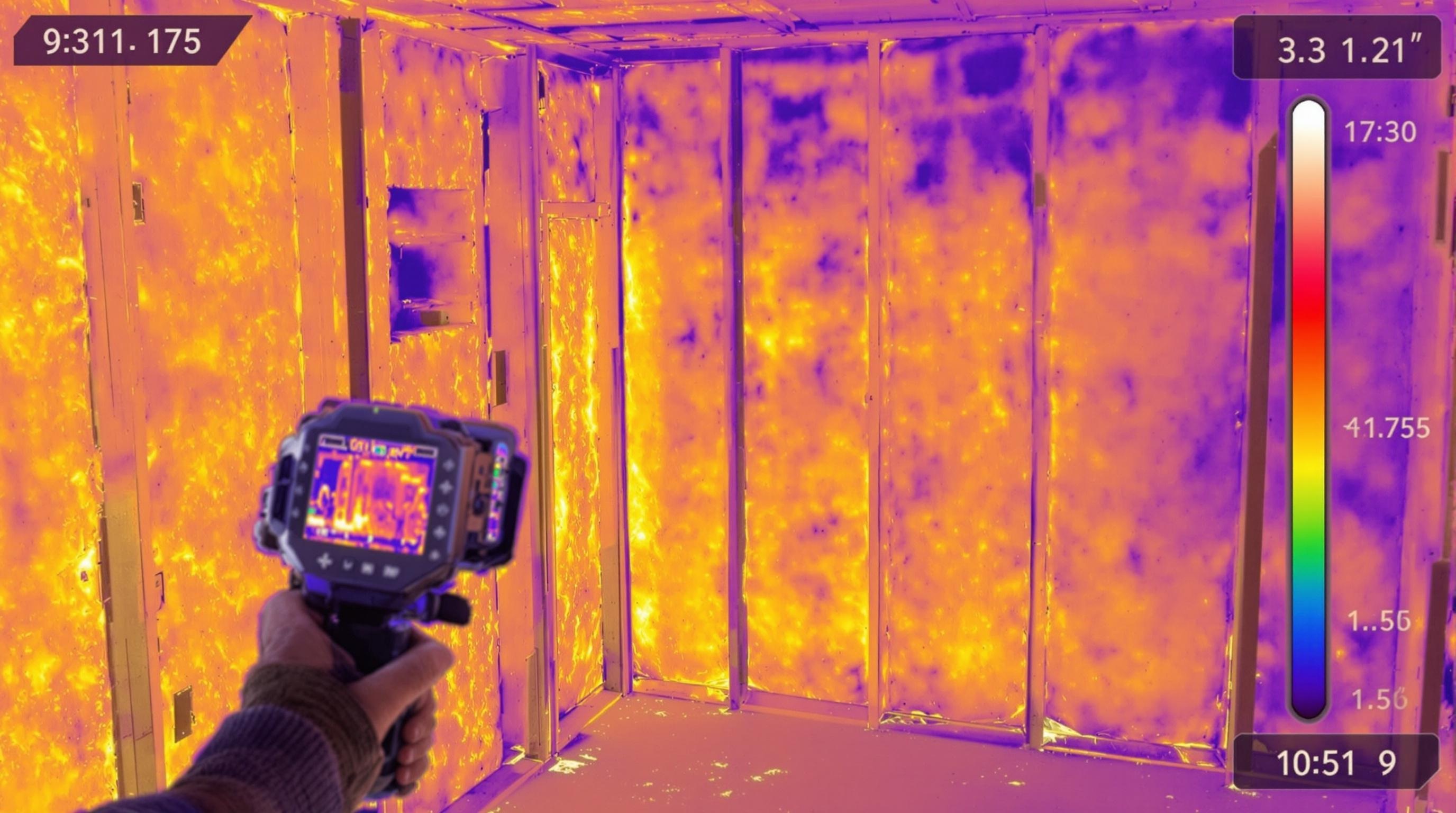

Regarding materials, here’s the lowdown: fiberglass, mineral wool, spray foam, natural and plastic fibers are good to go. Plus, air-sealing aids like caulk, weather stripping, and house wrap qualify too. But, you need a Manufacturer Certification Statement for air-sealing products to get the tax benefits. Your contractor or supplier should have the know-how to guide you there.

Confirming Home and Material Eligibility

Always ensure the products meet IRS guidelines for the tax credits. That certification statement is crucial. Check in with your contractor or supplier—they’re the best folks to confirm compliance and might even throw a few more pointers your way.

Maximize Your Tax Credits by Pairing with New Rebates

With a bit of strategy, you can squeeze even more value out of these energy efficiency perks. Consider spreading out your upgrades across several tax years to efficiently utilize credit limits. For instance, knock out attic insulation in one year, then tackle heat pumps the next.

There’s also the High-Efficiency Electric Home Rebate Act (HEEHRA) to consider. It can cover up to 100% of insulation costs for low-income households (topping out at $1,600), while moderate-income homes can claim up to 50%, also maxing at $1,600.

And don’t forget about the federal IRA and IIJA programs, which you can mix with state, local, or utility rebates. Together, these can equal big savings.

Crafting a Complete Rebate and Tax Credit Strategy

Check out what’s available in your local area. Many utility companies have rebates up for grabs. The secret sauce? Merging federal, state, and local incentives to squeeze out the most financial benefits.

Why Insulation Upgrades Matter

Beyond the bucks you’ll save, there’s more to love about insulation. A well-insulated home uses way less energy, slicing a good chunk off your monthly bills. It’s also a stride toward reducing your carbon footprint—using less energy cuts down on emissions from heating and cooling systems.

Bringing homes up to today’s energy standards boosts comfort and sets you up well for future energy regulations. With millions of under-insulated homes across the U.S., these upgrades make both immediate and long-term sense.

Key Benefits of Superior Insulation

- Slash energy use and lower those hefty utility bills.

- Keep your home snug in the winter and refreshingly cool in the summer.

- Help reduce carbon emissions, playing your part in sustainability.

Whether you’re leveraging the Energy Efficient Home Improvement Tax Credit or going for benefits with HEEHRA, insulation is a pivotal move toward a more energy-efficient home. It guarantees economic savings and helps nurture our planet. Fancy that!

Unlocking Financial and Environmental Gains through Insulation Upgrades

Ever thought about the impact a little home improvement can have on both your wallet and the planet? Imagine trimming down those pesky energy bills while doing your bit for Mother Earth. That’s where upgrading your insulation steps in, like a silent hero.

Right now, there are some sweet deals in the form of tax credits, rebates, and other energy-efficient solutions that can steer homeowners toward bigger savings and smaller carbon footprints. The Energy Efficient Home Improvement Tax Credit, along with programs like HEEHRA and IRA, sets up a pretty nifty framework. These programs are all about nudging folks toward handy upgrades, like adding better insulation or installing heat pumps. Sure, it may sound technical, but picture this: a warmer, cozier home that doesn’t leak your hard-earned money straight out the window!

Now, here’s the game-changer: these measures not only slash your energy bills but also shrink your carbon emissions, which is a win-win. Plus, with the flexibility to mix and match federal, state, and local incentives, you’ve got room to maneuver your finances. It’s like building a financial cushion while prepping your home for what the future throws your way. So, why not consider these impactful investments? They boost efficiency, comfort, and sustainability—making your home ready for anything.